The following defined benefit pension data of Dahl Corp. apply to the year 2020: The company applies

Question:

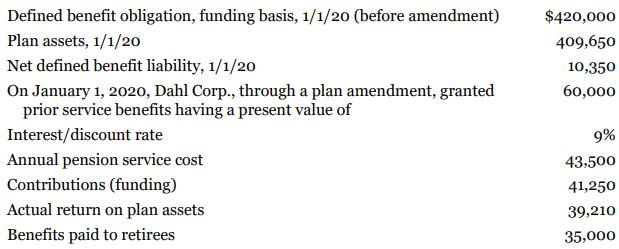

The following defined benefit pension data of Dahl Corp. apply to the year 2020:

The company applies ASPE and has made an accounting policy choice to base its actuarial valuation of the DBO on the funding basis.

Instructions

a. Prepare a continuity schedule for the DBO for 2020.

b. Prepare a continuity schedule for the plan assets for 2020.

c. Calculate pension expense for 2020 and prepare the entry to record the expense. Round to the nearest dollar.

d. Calculate the balance of the net defined benefit liability/asset at December 31, 2020.

e. Identify the plan's surplus or deficit at December 31, 2020. Compare it with the balance of the pension asset or liability reported on the balance sheet at the same date.

f. Identify what disclosures are required for pension expense on the income statement, and briefly explain why these disclosures are required.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy