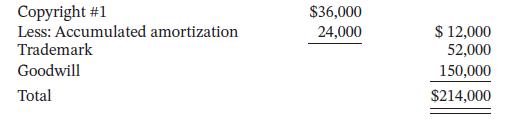

The intangible assets and goodwill section of Ghani Corporations balance sheet at December 31, 2023, is as

Question:

The intangible assets and goodwill section of Ghani Corporation’s balance sheet at December 31, 2023, is as follows:

The copyright was acquired in January 2022 and has an estimated useful life of three years. The trademark was acquired in January 2017 and is expected to have an indefinite useful life. The following cash transactions may have affected intangible assets during 2024:

Jan. 2 Paid $7,000 in legal costs to successfully defend the trademark against infringement by another company.

July 1 Developed a new product, incurring $275,000 in research costs and $50,000 in development

costs. A patent was granted for the product on July 1, and its useful life is equal to its legal life.

Aug. 1 Paid $45,000 to a popular hockey player to appear in commercials advertising the company’s products. The commercials will air in September and October.

Oct. 1 Acquired a second copyright for $168,000. The new copyright has an estimated useful life of six years.

Dec. 31 Recorded annual amortization.

Instructions

a. Prepare journal entries to record the transactions.

b. Show how the intangible assets and goodwill will be presented on the balance sheet at December 31, 2024.

Taking It Further

Since intangible assets do not have physical substance, why are they considered to be assets?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak