The management of Gresa Inc. is evaluating the appropriateness of using its present inventory cost determination method,

Question:

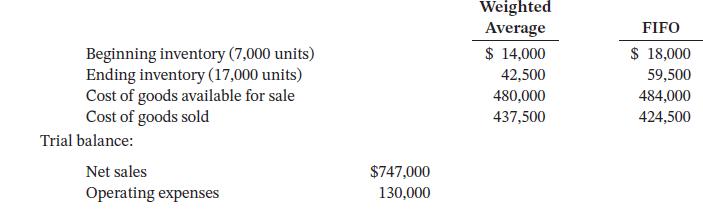

The management of Gresa Inc. is evaluating the appropriateness of using its present inventory cost determination method, which is weighted average. The company requests your help in comparing the results of operations for 2024 if FIFO were used instead. For 2024, you have been provided with the following information: Perpetual inventory records:

Instructions

a. Prepare comparative income statements for 2024 under weighted average and FIFO.

b. Answer the following questions:

1. Explain the advantages and disadvantages of using FIFO instead of weighted average, assuming a period of rising prices.

2. Assume Gresa Inc. is a hardware and home improvement retailer. Which cost formula would better match the physical flow of merchandise?

3. Assume instead that Gresa Inc. is a grocery retailer. Which cost formula would better match the physical flow of merchandise?

4. Based on your answers to part (a), which cost formula produces a higher net income?

Taking It Further

When is it appropriate to change from one method of inventory cost determination to another? Would management be motivated to change from weighted average to FIFO? Explain.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak