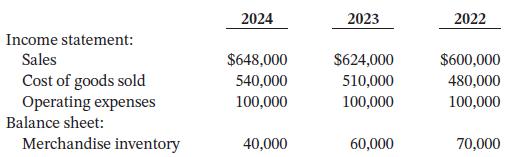

The records of James Company show the following data: After its July 31, 2024, year end, James

Question:

The records of James Company show the following data:

After its July 31, 2024, year end, James Company discovered two errors:

1. In August 2022, James recorded a $30,000 inventory purchase on account for goods that had been received in July 2022. The physical inventory account correctly included this inventory, and $70,000 is the correct amount of inventory at July 31, 2022.

2. Ending inventory in 2023 was overstated by $20,000. James included goods held on consignment for another company in its physical count.

Instructions

a. Prepare incorrect and corrected income statements for the years ended July 31, 2022, 2023, and 2024.

b. What is the combined effect of the errors on owner’s equity at July 31, 2024, before correction?

c. Calculate the incorrect and correct inventory turnover ratios for 2023 and 2024.

Taking It Further

Compare the trends in the incorrectly calculated annual profits with the trends in the correctly calculated annual profits. Does it appear that management may have deliberately made these errors, or do they appear to be honest errors? Explain.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak