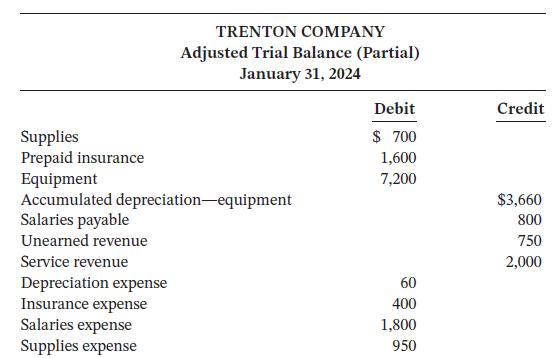

Trenton Companys fiscal year end is December 31. On January 31, 2024, the companys partial adjusted trial

Question:

Trenton Company’s fiscal year end is December 31. On January 31, 2024, the company’s partial adjusted trial balance shows the following:

Instructions

a. If $1,600 was received in January for services performed in January, what was the balance in Unearned Revenue at December 31, 2023?

b. If the amount in Depreciation Expense is the depreciation for one month, when was the equipment purchased?

c. If the amount in Insurance Expense is the January 31 adjusting entry, and the original insurance premium was for one year, what was the total premium, and when was the policy purchased?

d. If the amount in Supplies Expense is the January 31 adjusting entry, and the balance in Supplies on December 31, 2023, was $800, what was the amount of supplies purchased in January?

e. If the balance in Salaries Payable on December 31, 2023, was $1,200, what was the amount of salaries paid in cash during January?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak