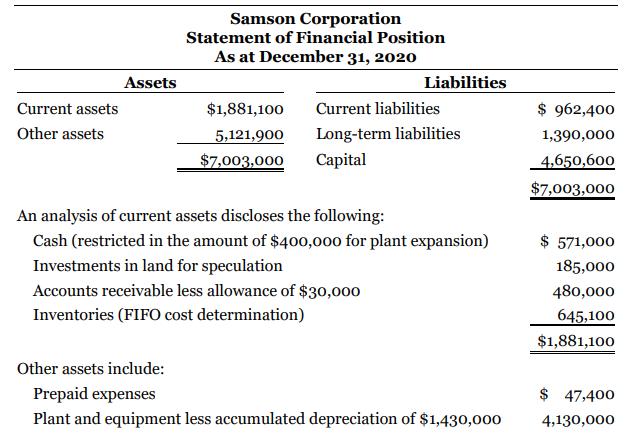

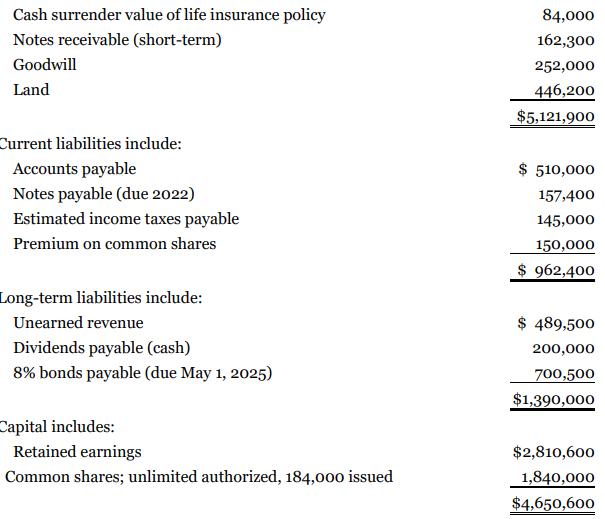

Your firm has been engaged to examine the financial statements of Samson Corporation for the year 2020.

Question:

Your firm has been engaged to examine the financial statements of Samson Corporation for the year 2020. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2014. The client provides you with the information that follows:

The following supplementary information is also provided:

1. On May 1, 2020, the corporation issued, at 93.4, $750,000 of bonds to finance plant expansion. The longterm bond agreement provided for the annual payment of interest every May 1. The existing plant was pledged as security for the loan. The bookkeeper has not made any entry for interest in 2020. Use the effective interest method for discount amortization. Round effective rate to two decimal places.

2. The bookkeeper made the following mistakes:

a. In 2018, the ending inventory was overstated by $183,000. The ending inventories for 2019 and 2020 were correctly calculated.

b. In 2020, accrued wages in the amount of $275,000 were omitted from the SFP and these expenses were not charged on the income statement.

c. In 2020, a gain of $175,000 (net of tax) on the sale of certain plant assets was credited directly to Retained Earnings.

3. A major competitor has introduced a line of products that will compete directly with Samson's primary line, which is now being produced in a specially designed new plant. Because of manufacturing innovations, the competitor's line will be of similar quality but priced 50% below Samson's line. The competitor announced its new line on January 14, 2021. Samson indicates that it will meet the lower prices; the lower prices are still high enough to cover Samson's variable manufacturing and selling expenses, but will permit only partial recovery of fixed costs.

4. You learned on January 28, 2021, before completion of the audit, of heavy damage from a recent fire at one of Samson's two plants and that the loss will not be reimbursed by insurance. The newspapers described the event in detail.

5. The bookkeeper informs you that Samson Corporation has been having some difficulty in collecting on several of its accounts receivable. For this reason, the bad debt expense percentage used was changed from 1.5% to 2.5% of sales. The controller estimates that if the new rate had been used in the past, an additional $40,000 worth of expense would have been charged. The bad debt expense for 2020 was calculated using the new rate of 2.5% of sales.

Instructions

a. Analyze the above information to prepare a corrected SFP for Samson in accordance with IFRS. Prepare a description of any notes that might need to be prepared. The books are closed and adjustments to income are to be made through retained earnings. Ignore the effects of income taxes, unless otherwise stated.

b. “The financial statements of a company are management's responsibility, not the auditor's.” Discuss the implications of this statement.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy