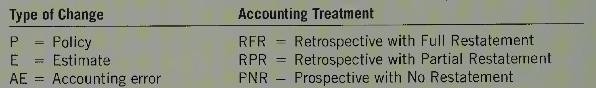

Analyze each case and choose a letter code under each category (type and approach) to indicate the

Question:

Analyze each case and choose a letter code under each category (type and approach) to indicate the preferable accounting for each case.

a. Changed depreciation method from declining-balance to straight-line because of information about how the assets were really used over the past three years.

b. Changed from cost method to revaluation method for capital assets; prior years' valuations are not obtainable.

c. Changed useful life of a machine based on evidence of wear and tear over time.

d. Changed from FIFO to average cost for inventory to conform to reduce accounting costs. Only the opening balance can be reconstructed.

e. Changed residual value of an intangible capital asset to zero based on new economic circumstances.

f. Recorded expense, \(\$ 17,200\); should be \(\$ 71,200\).

g. A private company changed from the percentage of completion method to completed contract method for all contracts currently in process and for all new contracts. All prior balances can be reconstructed.

h. Discovered that a \(\$ 400,000\) acquisition of machinery two years ago was debited to the land account.

i. Changed from historical cost to net realizable value for inventory valuation to comply with new accounting standards. The opening balance cannot be reconstructed.

j. Changed measurement method for asset retirement obligations to present value basis instead of undiscounted estimated costs.

Step by Step Answer: