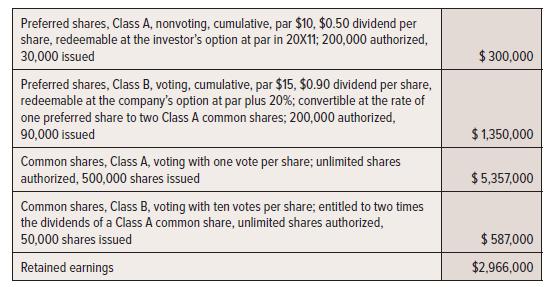

At 31 December 20X1, Regina Realty Ltd. had the following items on the statement of financial position:

Question:

At 31 December 20X1, Regina Realty Ltd. had the following items on the statement of financial position:

The Class A preferred shares are redeemable in 20X11 at the investors’ option and are classified as a liability. Dividends on these shares are reported as interest expense and have been deducted from earnings.

At 31 December 20X1, there were two common share Class A stock options outstanding:

• $10 per share exercise price and 60,000 shares, able to be exercised after 1 July 20X1 and expiring on 1 July 20X3.

• $9 per share exercise price and 88,000 shares, able to be exercised after 1 July 20X18 and expiring on 1 July 20X20.

During 20X2, the following occurred:

a. Net earnings was $1,140,000, correctly calculated.

b. Class A common shares were issued on 1 March 20X2 when the $10 options described above were fully exercised.

c. The tax rate was 40%.

d. The average Class A common share price during the period was $12, after giving effect to the stock split described below in (f). The adjusted average for January and February was $14.

e. No dividends were declared or paid to any of the shareholders.

f. There was a 3-for-1 stock split of the Class A and Class B common shares on 1 November.

All outstanding shares, option contracts, and conversion terms were adjusted accordingly.

Required:

Prepare the earnings per share disclosure for the year ended 31 December 20X2 in good form.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel