At the beginning of 20X4, Caprioli Tracking Corp. (CTC) had a deferred income tax liability on its

Question:

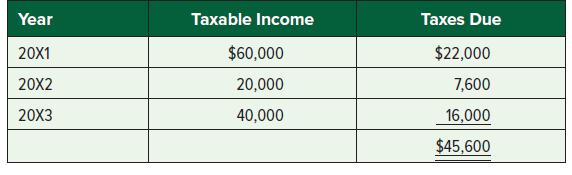

At the beginning of 20X4, Caprioli Tracking Corp. (CTC) had a deferred income tax liability on its statement of financial position of $60,000. The deferred income tax balance reflects the tax impact of gross accumulated temporary differences of $95,000 relating to CCA/depreciation and $55,000 relating to pension costs. The tax expense has been higher (i.e., CCA and pension funding have been higher) than the accounting expense (i.e., depreciation and pension expense). Over the past three years, taxes have been due and paid as follows:

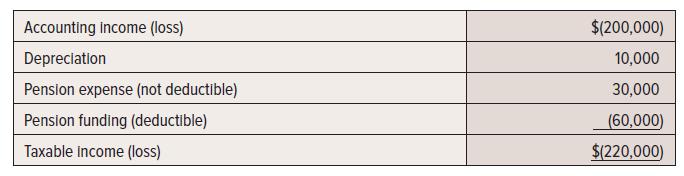

In 20X4, CTC suffered the first loss in its history due to a general economic turndown. The accounting loss amounted to $200,000 before taxes. In computing accounting earnings, CTC deducted depreciation of $10,000 per year. On its 20X4 tax return, CTC elected to take no CCA, and therefore the 20X4 loss for tax purposes was as follows:

The income tax rate, which had gradually increased over several years to 40% in 20X3, remained at 40% for 20X4 taxable income. In 20X4, Parliament enacted legislation to reduce the income tax rate to 36% for 20X5 and the following years.

In management’s judgement, it is probable that any tax loss carryforward will be fully utilized in the carryforward period.

Required:

Show the journal entry to record income taxes. Prepare the lower part of the CTC SCI for 20X4, starting with “earnings before income tax.”

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel