At the end of 20X6, Tap Ltd. had accumulated temporary differences of $500,000 arising from CCA/depreciation on

Question:

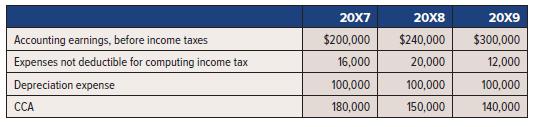

At the end of 20X6, Tap Ltd. had accumulated temporary differences of $500,000 arising from CCA/depreciation on capital assets. UCC was $2,500,000 and net book value of these assets was $3,000,000. The balance of the deferred income tax liability account was $150,000. Over the next three years, Tap reported the following:

The tax rate was 30% for 20X6 and 20X7, 26% for 20X8, and 24% for 20X9.

Required:

1. Calculate income tax expense for each year, 20X7, 20X8, and 20X9. Assume that the rates for 20X8 and 20X9 were enacted in the year to which they pertain. Specify the amount of current income tax expense and deferred income tax expense for each year.

2. Calculate the amount of the change in deferred tax in each year that is caused by the change in the tax rate, versus the effect of new temporary differences.

3. Assume instead that the rates for 20X8 and 20X9 were both enacted in 20X7. Recalculate income tax expense in 20X7. State any additional assumptions that you make.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel