Candida Ltd. is a Canadian public company in the business of exploration, production, and marketing of natural

Question:

Candida Ltd. is a Canadian public company in the business of exploration, production, and marketing of natural gas. It also has power generation operations. Earnings in 20X5 were $2.4 billion, and total assets were $24.1 billion.

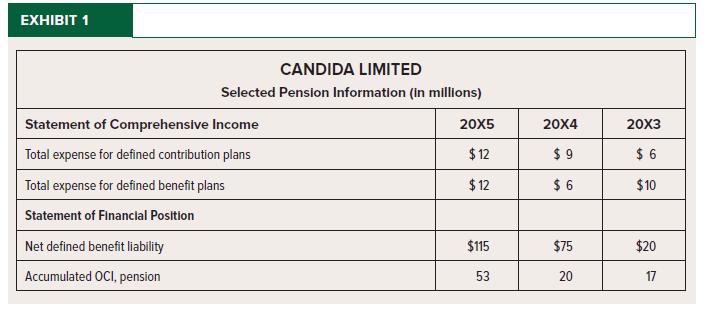

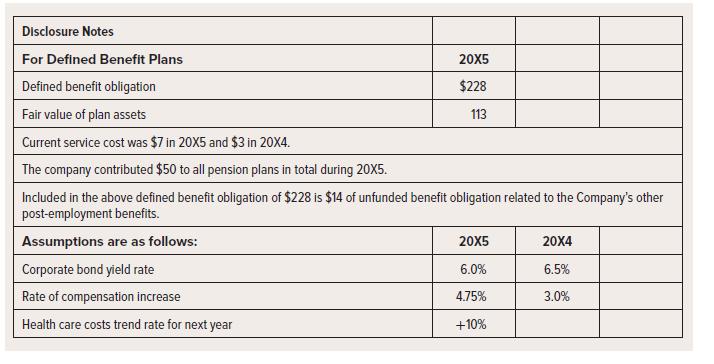

You have recently begun work in the finance and accounting department. Your immediate task is to analyze and report on the pension information (see Exhibit 1) included in the last annual report. Your supervisor provided this information with a request:

We have to prepare for an upcoming meeting of the audit committee. We have several new members of the committee, and the chairperson has suggested that we provide a brief report on Candida’s pension issues to get everyone up to speed. It has been several years since we have discussed this issue in depth so this seems like a great opportunity.

Your report should include an explanation of defined benefit plans versus defined contribution plans (we have both but are curtailing the former), and the financial statement elements that relate to each plan. It will be necessary to explain the nature of the defined benefit obligation for the defined benefit plans and the pension plan asset balances and relate these amounts to the $115 million net defined benefit liability we include on the statement of financial position. We are particularly concerned about our potential pension position for 20X6, the coming year. We will see an increase in compensation cost of about 5%, which will accordingly increase pension cost. On top of the large investment losses we experienced in 20X5, this may mean serious increases in pension amounts. Your report should review the accounting treatment of the investment loss but also project our 20X6 pension expense. Finally, since our pension expense is likely going to be problematic next year, you should identify some key assumptions that Candida can consider to help reduce pension expense.

Required:

Prepare the report.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel