Compass Direction Ltd. has constructed a warehouse facility, paying $560,000 for land on 1 February 20X2, $500,000

Question:

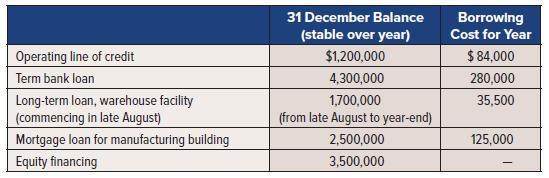

Compass Direction Ltd. has constructed a warehouse facility, paying $560,000 for land on 1 February 20X2, $500,000 to a contractor in late March 20X2, another $2,000,000 in late August 20X2, and finally $1,200,000 in late November 20X2. The warehouse was put into use in early December 20X2. The company had one construction loan, a note payable for $1,700,000. This money was borrowed in late August 20X2. The rest of the acquisition was financed through general borrowing. The company’s capital structure and borrowing costs for the year:

Required:

1. Calculate the cost of general borrowing, and indicate when the capitalization period ends for borrowing costs.

2. Calculate the borrowing cost that is to be capitalized as part of the warehouse asset.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel