Ellis Ingram Corporation (EIC) is a manufacturer of household appliances. The company is privately held with a

Question:

Ellis Ingram Corporation (EIC) is a manufacturer of household appliances. The company is privately held with a broad shareholder group. The company has sizable loans outstanding, and audited financial statements are required to assess compliance with loan covenants, related to the current ratio and return on assets. A material component of management compensation is bonus payments, a fixed portion of net income.

After several years of positive earnings, EIC is reporting sizable losses in 20X5. These losses relate to a strike that shut down EIC's major manufacturing facility. While the operation was shut down, many customers found other suppliers. EIC is slowly regaining market share. Market projections are cautious for 20X6, as consumer demand is expected to be soft, and EIC's customer base is still impaired. No bonuses will be paid in 20X5. Lenders have agreed to a one-year exclusion on debt covenants related to return on assets for 20X5, but 20X6 profits will be carefully watched.

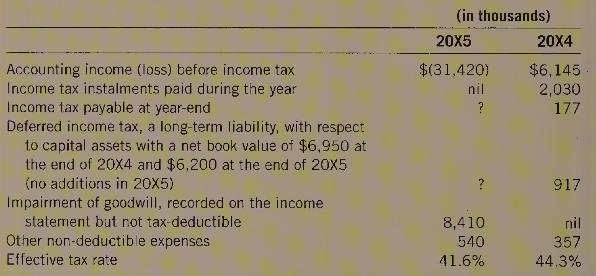

EIC has provided the following information with respect to operating results:

EIC reported total taxable income of \(\$ 2,680\) in \(20 \times 3\) and \(20 \times 2\) combined, on which income tax of \(\$ 1,187\) was paid. No CCA will be claimed in \(20 X 5\).

A major issue for management and the Board of Directors of EIC is the probability assessment of loss carryforward use at the end of 20X5. In order to facilitate discussion, you, a public accountant, have been asked to prepare financial statement results for both alternatives-probable and not probable-and comment on the implications of the choice for 20X6. Your analysis must include all tax amounts and necessary calculations. You have also been asked to analyze the status of the gross profit on the late-20X5 sale of merchandise to Luciano Limited. If adjustment is needed, you are to revise the reported financial results.

Required:

Prepare the requested analysis.

Step by Step Answer: