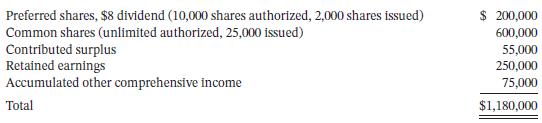

Falkon Corp. reported the following amounts in the shareholders equity section of its December 31, 2022 SFP:

Question:

Falkon Corp. reported the following amounts in the shareholders’ equity section of its December 31, 2022 SFP: During 2023, the company had the following transactions that affect shareholders’ equity:

During 2023, the company had the following transactions that affect shareholders’ equity:

1. Paid the annual 2022 $8 per share dividend on preferred shares and a $3 per share dividend on common shares. These dividends had been declared on December 31, 2022.

2. Purchased 3,700 of its own outstanding common shares for $35 per share and cancelled them.

3. Issued 1,000 preferred shares at $105 per share (at the beginning of the year).

4. Declared a 10% stock dividend on the outstanding common shares at their fair value when the shares were selling for $45 per share. 5. Issued the stock dividend. 6. Declared the annual 2023 $8 per share dividend on preferred shares and a $2 per share dividend on common shares. These dividends are payable in 2024.

The contributed surplus arose from net excess of proceeds over cost on a previous cancellation of common shares. Total assets at December 31, 2022, were $2,140,000, and total assets at December 31, 2023, were $2,616,000. The company follows IFRS.

Instructions

a. Prepare journal entries to record the transactions above.

b. Prepare the statement of changes in shareholders’ equity for the year ended December 31, 2023.

Assume 2023 net income was $450,000 and comprehensive income was $455,000.

c. Prepare the December 31, 2023 shareholders’ equity section.

d. Calculate the rate of return on common shareholders’ equity and the rate of return on total assets for 2023. Round to two decimal places. Is Falkon trading on the equity? Evaluate the results from the perspective of a common shareholder.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119740445

13th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy