Mullen Music Limited (MML) carries a wide variety of musical instruments, sound reproduction equipment, recorded music, and

Question:

Mullen Music Limited (MML) carries a wide variety of musical instruments, sound reproduction equipment, recorded music, and sheet music. MML uses two sales promotion techniques—warranties and premiums—to attract customers.

Musical instruments and sound equipment are sold with a one-year warranty for replacement of parts and labour. The estimated warranty cost, based on experience, is 2% of net sales.

A premium is offered on the recorded and sheet music. Customers receive one point for each dollar spent on recorded music or sheet music. Customers may exchange 200 points plus $20 for a set of speakers. MML pays $34 for each set of speakers and estimates that 60% of the points given to customers will be redeemed.

MML’s net sales for 2023 were $7.2 million: $5.4 million from musical instruments and sound reproduction equipment, and $1.8 million from recorded music and sheet music. Replacement parts and labour for warranty work totalled $164,000 during 2023. A total of 6,500 sets of speakers used in the premium program were purchased during the year, and 1.2 million points were redeemed in 2023.

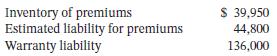

The expense approach is used by MML to account for the warranty and premium costs for financial reporting purposes. The balances in the accounts related to warranties and premiums on January 1, 2023, were:

Instructions

a. MML is preparing its financial statements for the year ended December 31, 2023, in accordance with ASPE. Determine the amounts that will be shown on the 2023 financial statements for the following:1. Warranty expense

2. Warranty liability

3. Premium expense

4. Inventory of premiums

5. Estimated liability for premiums

b. Assume that MML’s auditor determined that both the one-year warranty and the points for the sets of speakers were, in fact, revenue arrangements with multiple deliverables that should be accounted for under the revenue approach because MML is following IFRS. Explain how this would change the way in which these two programs were accounted for in part (a).

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119740445

13th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy