On 31 December 20X2, the shareholders equity section of Sersa Corp.s statement of financial position was as

Question:

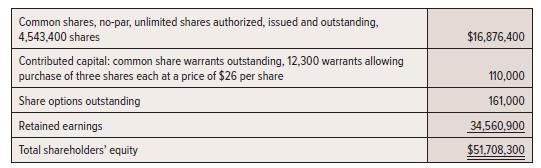

On 31 December 20X2, the shareholders’ equity section of Sersa Corp.’s statement of financial position was as follows:

There were 46,000 share options outstanding, issued for legal services, valued at $161,000. These allow purchase of one share each for $19 cash; the options are exercisable over several years. Transactions during the year:

a. Options were issued to existing shareholders as a poison pill in the case of a hostile takeover. These options allow purchase of two shares for each existing share held at a price of $1 each, to be exercisable only under certain limited conditions.

b. Warrants outstanding at the beginning of the year were exercised in full. The market value of the shares was $40.

c. Some outstanding $19 share options were exercised and 10,000 shares were issued. Remaining share options were not exercised in the current year. The market value of the shares was $40.

d. Options were issued that allow purchase of a total of 2,000 shares at a price of $32 per share, beginning in 20X4. The options were issued for four months of 20X3 rent, which was set by contract at $4,000 per month.

e. Options were issued for proceeds of $45,000, allowing purchase of 40,000 shares at a price of $35 per share.

f. One-quarter of the options issued in (e) were exercised. The market value of the shares was $48.

Required:

1. Provide journal entries for each of the transactions listed above.

2. Prepare the shareholders’ equity section of the statement of financial position, reflecting the transactions recorded in requirement 1.

3. What items would appear on the statement of cash flows in the financing activities section as a result of the changes in the equity accounts documented in requirement 2?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel