Remnant Inc. is a public company that reports under IFRS and has a 31 December year-end. Over

Question:

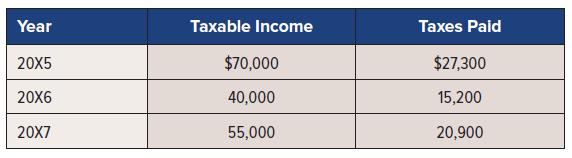

Remnant Inc. is a public company that reports under IFRS and has a 31 December year-end. Over the past three years the company has reported taxable income and paid taxes as follows:

At the end of 20X7, Remnant Inc. reported a deferred tax liability on its SFP of $57,000, which relates to the difference in treatment of warranty for tax and accounting purposes.

During 20X8 Remnant experienced a financial loss. This was the company’s first loss and it totalled $350,000 before taxes. Included in this total was a deduction for warranty expense in the amount of $60,000. Deductible warranty payments for 20X8 were $42,000. The warranty liability reported on the 20X8 SFP was $168,000.

Remnant Inc.’s tax rate in 20X7 and 20X8 was 38%. The tax rate enacted for 20X9 was 35%. The loss in 20X8 was the result of a market-wide economic downturn. However, by late 20X8 the market was already reflecting slight signs of improvement. Therefore, management believed that any tax loss carryforward amounts would be fully utilized in the carryforward period.

Required:

1. Calculate the carryback amount in 20X8 and any amount that Remnant Inc. can claim as a refund.

2. Calculate the remaining carryforward balance, if any.

3. Prepare the journal entry to record income taxes for 20X8.

4. Prepare the lower part of Remnant Inc.’s SCI for 20X8. Start with “earnings before income tax.”

5. Describe how your answer for requirement 2 would differ if management deemed it not probable that the tax loss could be utilized.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel