Signs and Designs Inc. (SDI) is a company operating in the advertising industry. SDL provides companies with

Question:

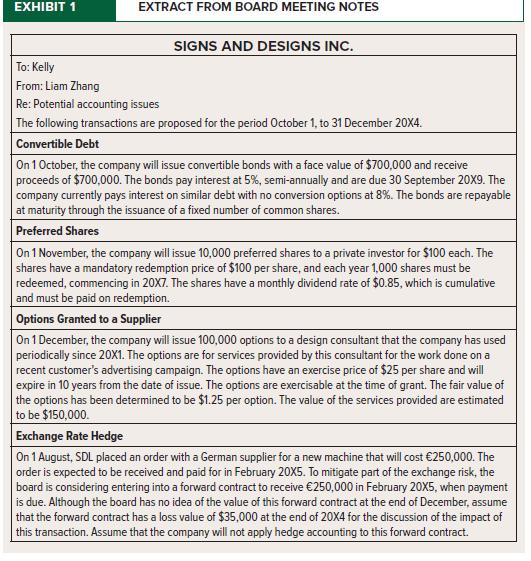

Signs and Designs Inc. (SDI) is a company operating in the advertising industry. SDL provides companies with designs for new signage and company logos. The company has a profit-sharing plan whereby 25% of the company’s earnings before taxes are distributed to employees who have been with the company for the entire year. It is now late September 20X4, and Liam Zhang, the company’s CFO, is currently preparing a draft of the company’s financial statements for the year ended 31 December 20X4, to determine the amount of bonus to be paid out to the employees. It has been decided at a recent board meeting that the company will enter into four unusual transactions during the period October to December. CEO Derrick Voshart has asked for a memo on the impact of these transactions on the bonus amount available for the employees. Extracts from the recent board meeting outlining the proposed transactions are provided in Exhibit 1. The net earnings for the year ended 31 December 20X4 and 20X5 are forecasted to be $850,000 before taxes and any impact of these proposed transactions.

Required:

You, Kelly, work for the CFO, who has asked you to review the notes and prepare a memo outlining accounting and reporting issues and alternatives for each of the four transactions proposed. Liam would like you to outline the impact on the statement of financial position and net profit or loss before tax for 20X4 and 20X5. (Prepare the journal entry to be recorded at the time of issue for each transaction.) This memo will be the basis for the meeting with Derrick Voshart.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel