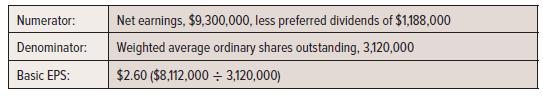

Targeted Ltd. (TL) reports the following calculations for basic EPS, for the year ended 31 December 20X4:

Question:

Targeted Ltd. (TL) reports the following calculations for basic EPS, for the year ended 31 December 20X4:

Assume two different scenarios for Targeted Ltd.—Case A versus Case B as shown below:

Case A

Assume that TL had 400,000 convertible preferred shares outstanding at the beginning of the year. Each share was entitled to a dividend of $2 per year, payable $0.50 each quarter.

Each share is convertible into three common shares. After the third-quarter dividend was paid, 100,000 preferred shares converted to 300,000 common shares. The information above regarding dividends paid and the weighted average ordinary shares outstanding properly reflects the conversion for the purposes of calculating basic EPS.

Case B

Assume instead that TL had nonconvertible preferred shares outstanding in 20X4, on which dividends of $1,188,000 were paid. Also assume that TL had convertible bonds outstanding at the beginning of 20X4. On 1 November, the entire bond issue was converted to 1,200,000 common shares, per the bond agreement. The information above regarding earnings properly reflects interest expense of $1,401,659 from 1 January to 1 November. The weighted average ordinary share figure also reflects the appropriate common shares for the conversion. The tax rate is 25%. TL also had options outstanding at the end of the fiscal year, for 250,000 common shares at an option price of $17. The average common share price was $27 during the period.

Required:

Calculate diluted EPS for each of Case A and Case B, independently.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel