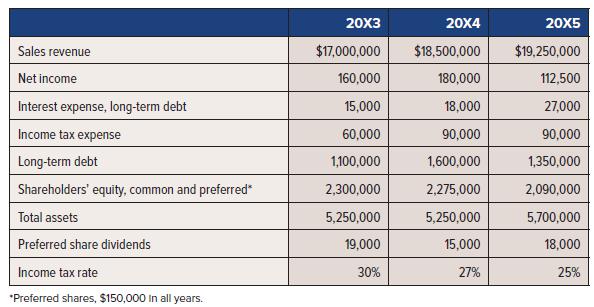

The 20X5 comparative financial statements for Wilson Corp. reported the following selected information: Required: 1. Based on

Question:

The 20X5 comparative financial statements for Wilson Corp. reported the following selected information:

Required:

1. Based on the above financial data, compute the following ratios for 20X4 and 20X5:

a. Return on total assets, before tax

b. Return on total assets, after tax

c. Return on long-term capital, before tax

d. Return on long-term capital, after tax

e. Return on common shareholders’ equity

f. Operating margin

g. Asset turnover

2. As an investor in the common shares of Wilson, which ratio would you prefer as a primary measure of profitability? Why?

3. Explain any significant trends that appear to be developing.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel