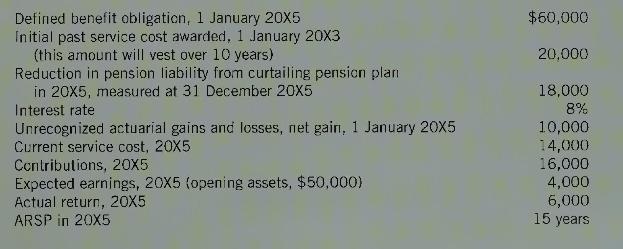

The following information relates to a defined benefit pension plan: Required: 1. Provide the entries to record

Question:

The following information relates to a defined benefit pension plan:

Required:

1. Provide the entries to record pension expense and cash paid to the trustee for 20X5. The company follows the practice of amortizing actuarial gains and losses to pension expense when the 1 January amount is outside the \(10 \%\) corridor. The curtailment involves benefits to employees' activities in the normal course of business.

2. Repeat requirement (1) assuming that the company includes all actuarial gains and losses in pension expense in the year that they arise. For this part, the unrecognized actuarial gains and losses at 1 January \(20 \times 5\) are zero.

3. Calculate pension expense for \(20 \mathrm{X} 5\) assuming this is a private company that has elected to use the simplified approach to pension accounting. Assume that there was no curtailment in this requirement, and no carryforwards of actuarial gains.

Step by Step Answer: