The shareholders equity of Cameron Corp. as of 31 December 20X6, the end of the current fiscal

Question:

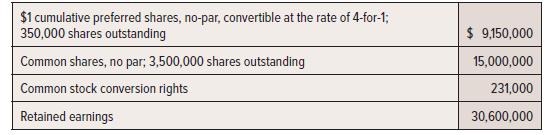

The shareholders’ equity of Cameron Corp. as of 31 December 20X6, the end of the current fiscal year, is as follows:

Additional information:

• On 1 July 20X6, 150,000 preferred shares were converted to common shares at the rate of 4-for-1.

• During 20X6, Cameron had convertible subordinated debentures outstanding with a face value of $4,000,000. The debentures are due in 20X12, at which time they may be converted to common shares or repaid at the option of the holder. The conversion rate is 12 common shares for each $100 debenture. Interest expense of $175,000 was recorded in 20X6.

• The convertible preferred shares had been issued in 20X0. Quarterly dividends, on 31 March, 30 June, 30 September, and 31 December, have been regularly declared.

• The company’s 20X6 net earnings were $2,289,000, after tax at 30%. Common shares traded for an average price of $18, stable in each quarter of the year.

• Cameron had certain employee stock options outstanding all year. The options were to purchase 600,000 common shares at a price of $14 per share. The options become exercisable in 20X13.

• Cameron had another 100,000 employee stock options outstanding on 1 January 20X6, at an exercise price of $22. They expired on 30 June 20X6.

Required:

Show the EPS presentation that Cameron would include on its 20X6 statement of comprehensive income.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel