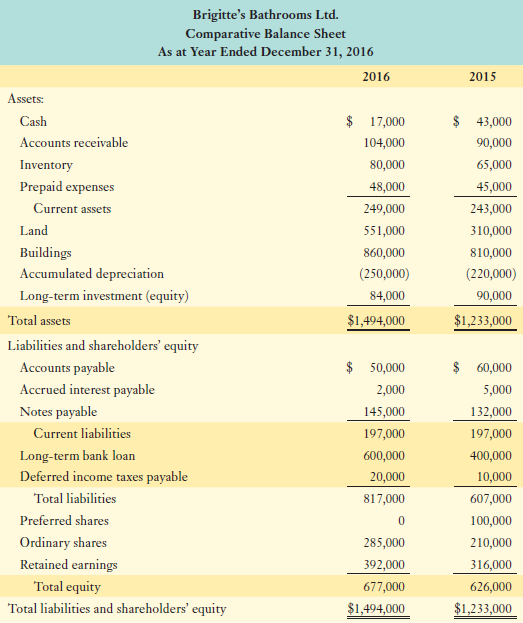

Brigittes Bathrooms Ltd. balance sheet for the year ended December 31, 2016, follows: Additional information: During the

Question:

Additional information:

- During the year, Brigitte declared and paid cash dividends of $50,000. They also declared and distributed stock dividends valued at $20,000.

- Brigitte bought and sold land during the year. The land that was sold for $200,000 originally cost $250,000.

- Brigitte€™s long-term investment consists of holding ordinary shares in one company (GFF Services Inc.). For most of the year, Brigitte owned 50,000 of the 200,000 ordinary shares outstanding. GFF€™s net income for the year (which ended December 15) was $40,000. GFF€™s income from December 16 to December 31 was not material. The company paid dividends of $100,000 on December 15. Brigitte bought additional shares in GFF on December 31.

- A gain of $25,000 was realized on the sale of a building that cost $200,000. Accumulated depreciation at time of sale was $150,000.

- Brigitte borrowed money from a finance company, which accounted for the increase in notes payable.

- The company€™s expenses for the year included $40,000 for income tax and $30,000 for interest.

- Brigitte€™s policy is to report investment income and interest paid in the cash flows from operating activities section, while dividends paid are classified as a cash outflow from financing activities.

Required:

a. Prepare a statement of cash flows for Brigitte€™s Bathrooms Ltd. for 2016 using the indirect method.

b. Identify what supplemental disclosure, if any, is required.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: