Cherokee Construction Company began operations in 2011 and changed from the completed-contract to the percentage-of-completion method of

Question:

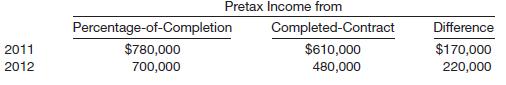

Cherokee Construction Company began operations in 2011 and changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2012. For tax purposes, the company employs the completed-contract method and will continue this approach in the future. (Hint: Adjust all tax consequences through the Deferred Tax Liability account.) The appropriate information related to this change is as follows.

Instructions

(a) Assuming that the tax rate is 35%, what is the amount of net income that would be reported in 2012?

(b) What entry(ies) are necessary to adjust the accounting records for the change in accounting principle?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: