Cleveland Company is a U.S. firm with a U.S. dollar functional currency that manufactures copper-related products. It

Question:

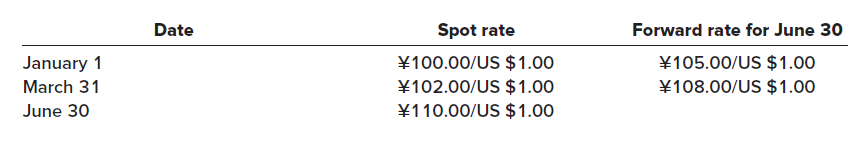

Cleveland Company is a U.S. firm with a U.S. dollar functional currency that manufactures copper-related products. It forecasts that it will sell 5,000 feet of copper tubing to one of its largest customers at a price of ?50,000,000. Although this sale has not been firmly committed, Cleveland expects that the sale will occur in six months on June 30, 2022. Thus, Cleveland is exposed to changes in foreign currency exchange rates. To reduce this exposure, Cleveland enters into a six-month foreign currency exchange forward contract with a third-party dealer on January 1, 2022, to deliver ? and receive US$. The foreign exchange contract has the following terms:Contract amount: ?50,000,000Maturity date: June 30, 2022Forward contract rate: ?105.00 = US $1.00

Yen / US$ Exchange rates:

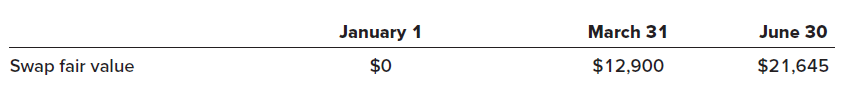

Cleveland obtains the fair values of the forward exchange contract from the third-party dealer.

Required:1. Calculate the net settlement on June 30, 2022.2. Prepare the journal entries for the period January 1 to June 30, 2022, to record the forward contract, necessary adjustments for changes in fair value, and settlement.

DealerA dealer in the securities market is an individual or firm who stands ready and willing to buy a security for its own account (at its bid price) or sell from its own account (at its ask price). A dealer seeks to profit from the spread between the...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas