Crocker Corp. owes D. Yaeger Corp. a 10-year, 10% note in the amount of $330,000 plus $33,000

Question:

Crocker Corp. owes D. Yaeger Corp. a 10-year, 10% note in the amount of $330,000 plus $33,000 of accrued interest. The note is due today, December 31, 2020. Because Crocker Corp. is in financial trouble, D. Yaeger Corp. agrees to forgive the accrued interest, $30,000 of the principal, and to extend the maturity date to December 31, 2023. Interest at 10% of revised principal will continue to be due on 12/31 each year.

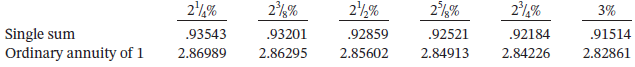

Assume the following present value factors for 3 periods.

Instructions

a. Compute the new effective-interest rate for Crocker Corp. following restructure.

b. Prepare a schedule of debt reduction and interest expense for the years 2020 through 2023.

c. Compute the gain or loss for D. Yaeger Corp. and prepare a schedule of receivable reduction and interest revenue for the years 2020 through 2023.

d. Prepare all the necessary journal entries on the books of Crocker Corp. for the years 2020, 2021, and 2022.

e. Prepare all the necessary journal entries on the books of D. Yaeger Corp. for the years 2020, 2021, and 2022.

MaturityMaturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel