Dale, a colleague of yours who has a rudimentary understanding of income tax reporting, has come to

Question:

Dale, a colleague of yours who has a rudimentary understanding of income tax reporting, has come to you for your expert advice on a number of issues that have confounded him. Specifically, he has three questions.

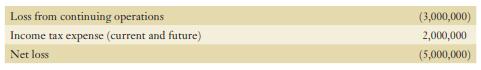

a. Is it possible for a company to report a loss before income taxes and income tax expense (current and future) together? Said differently, is it possible for a company to report the following?

b. SunRise Ltd. made an investment in SunSet Inc. and classified it as available for sale. SunRise purchased 30,000 shares on August 1 of the current fiscal year for $12 per share. By the end of the fiscal year (December 31), shares of SunSet traded at $14 per share. Dale is wondering how to account for this investment and its related tax effects.

c. Suppose a company opts to carry a loss forward rather than to carry it back to past years. Would it be rational to do so and when would it be optimal? Assume the tax rate is 40%.

Required:

Draft a response to Dale that explains these issues to your colleague.

Step by Step Answer: