Delta Air Lines revealed in its 10-K filing that its valuation allowance for deferred tax assets at

Question:

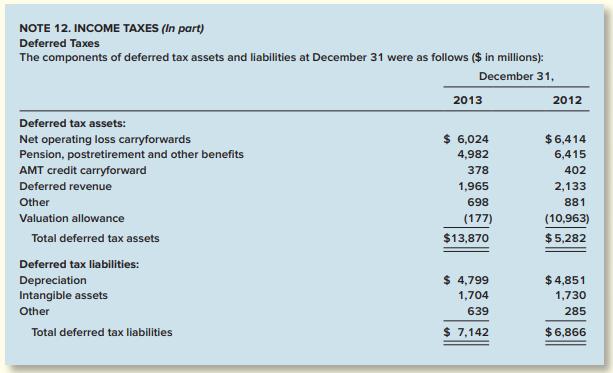

Delta Air Lines revealed in its 10-K filing that its valuation allowance for deferred tax assets at the end of 2013 was $177 million, dramatically lower than the over $10 billion recorded at the end of 2012. Here is an excerpt from a press report from Bloomberg in January 2014, regarding this allowance:

Delta Air Lines Inc. (DAL) led shares of U.S. carriers higher after posting fourth-quarter profit that topped analysts’ estimates and forecasting an operating margin of as much as 8 percent in this year’s initial three months. . . . Airlines are benefiting from lower fuel prices, constraints on capacity growth, controls on operating costs and demand that’s keeping planes full, said Ray Neidl of Nexa Capital Partners LLC, a Washington-based aerospace and transportation consulting firm. . . . Net income was $8.48 billion, including an $8 billion non-cash gain from the reversal of a tax valuation allowance.

The following is an excerpt from a disclosure note to Delta’s 2013 financial statements:

Required:

1. What is a valuation allowance against deferred tax assets? When must such an allowance be recorded? Use Delta’s situation to help illustrate your response.

2. Is an amount recorded in a valuation allowance for a deferred tax asset permanent? Explain why Delta is able to reclaim its valuation allowance.

3. Consider the excerpt from Bloomberg’s press release. Recalculate the effect on Delta’s 2013 net income of the change in Delta’s valuation allowance for its deferred tax assets.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas