For each of the following differences between the amount of taxable income and income recorded for financial

Question:

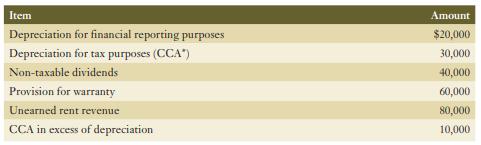

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes, compute the effect of each difference on deferred taxes balances on the balance sheet. Treat each item independently of the others. Assume a tax rate of 25%.

CCA = capital cost allowance

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: