For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired

Question:

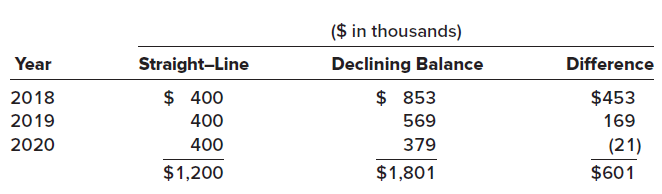

For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2018 for $2,560,000. Its useful life was estimated to be six years with a $160,000 residual value. At the beginning of 2021, Clinton decides to change to the straight-line method.The effect of this change on depreciation for each year is as follows:

Required:1. Will Clinton apply the straight-line method retrospectively or apply the straight-line method prospectively?2. Prepare any 2021 journal entry related to the change.

($ in thousands) Declining Balance $ 853 Year Straight-Line Difference $ 400 $453 2018 569 2019 400 169 2020 400 379 (21) $1,801 $1,200 $601

Step by Step Answer:

Requirement 1 In general we report voluntary changes in accounting principles retrospectively Howeve...View the full answer

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

At Precision Custom Molds, manufacturing overhead was estimated to be $20,000,000 at the start of the year and direct labor hours were estimated to be 200,000. Overhead is applied to jobs using a...

-

On December 31, the warranty liability was estimated to be $100,000. On January 16 of the following year, results of a study done before December 31 were received. These study results indicate that...

-

On December 31, the warranty liability was estimated to be $100,000. On January 16 of the following year, it was learned that one week before, on January 9, poor-quality materials were introduced...

-

In Exercises verify the identity. coshx = 1 + cosh 2x 2

-

Explore these graphs, using a friendly window with a factor of 2 and -10 ( t ( 10. a. Graph x = t and y = |t|. b. Graph x = t - 1 and y = |t| + 2. How does this graph compare with the graph in 4a? c....

-

True or False Indian Accounting standard (Ind AS 28) deals with accounting for investments in associates.

-

Teddys daily budget constraint is shown in the following chart. Teddys employer pays him a base wage rate plus overtime if he works more than the standard hours. What is Teddys daily nonlabor income?...

-

(One Temporary Difference, Tracked 3 Years, Change in Rates, Income Statement Presentation) Crosley Corp. sold an investment on an installment basis. The total gain of $60,000 was reported for...

-

Discuss the market concentration, competitiveness, and performance of the Australian grocery industry compared to other western countries. Identify the key stakeholders in the food supply chain, and...

-

Thornby Inc. has completed its fiscal year on December 31. The auditor, Kim Holmes, has approached the CFO, Brad Potter, regarding the year-end receivables and inventory levels of Thornby Inc. The...

-

In 2021, internal auditors discovered that PKE Displays, Inc., had debited an expense account for the $350,000 cost of a machine purchased on January 1, 2018. The machines useful life was expected to...

-

Refer to the situation described in BE 2010. Assume the error was discovered in 2023, after the 2022 financial statements are issued. Ignoring income taxes, what journal entry will PKE use to correct...

-

x 5 = 18 Change each exponential expression to an equivalent expression involving a logarithm.

-

How does innovation influence new product development and ultimately lead to business growth? Explain.

-

Draft a detailed report The head of your company has asked you to make a report on ways to reduce spending in your department without losing productivity. Craft a one-page report with the following...

-

How do you know and understand as a manager when it is time to change the payment system in your company besides doing meetings and receiving feedback from the employees? cite all references please

-

Find an equation of the line satisfying the given conditions. K 5x Passing through (10,-5) and perpendicular to the line 2y = - +2 8 The equation of the line is . (Simplify your answer. Type your...

-

Learning Outcomes 1. To demonstrate an understanding of writing business letter Process: 1. You need to put in writing letter to the leaders of a local organization (such as the YMCA, Other...

-

Alosio Manufacturing Company manufactures a variety of tools and industrial equipment. The company operates three divisions. Each division is an investment centre. Operating data for the home...

-

Define cultural intelligence. Cite the books or journal articles you found in Capella's library. Explain why cultural intelligence is important for HR practitioners and other organizational managers.

-

How does separating current assets from property, plant, and equipment in the balance sheet help analysts?

-

How does separating current assets from property, plant, and equipment in the balance sheet help analysts?

-

How does separating current assets from property, plant, and equipment in the balance sheet help analysts?

-

Determine the key elements in appraising various types of quantitative research designs, which might be useful for your own nursing practice. 4. Illustrate key concepts relevant to quantitative...

-

Is the big-box store practicing illegal price competition? Explain your answer. If it is, what federal act is it violating? If the big-box store is not practicing illegal price competition, how can...

-

1.) Consider the baggage check-in of a small airlineCheck in data indicates that from 9 a.m to 10 a.m, 255 passenger check inMoro ever, based on counting the numbers of passengers waiting in line for...

Study smarter with the SolutionInn App