I Love Debt Inc. is in the process of acquiring another business. In light of the acquisition,

Question:

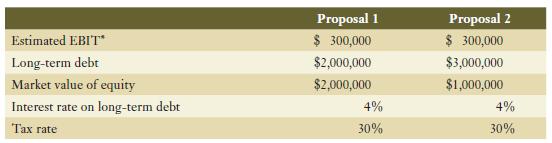

I Love Debt Inc. is in the process of acquiring another business. In light of the acquisition, shareholders are currently re-evaluating the appropriateness of the firm’s capital structure (the types of and relative levels of debt and equity). The two proposals being contemplated are detailed below:

*Earnings before interest and taxes

Required:

a. Calculate the estimated return on equity (ROE) under the two proposals. [ROE = net income after taxes ÷ market value of equity; net income after taxes = (EBIT − interest on long-term debt) × (1 − tax rate)]

b. Which proposal will generate the higher estimated ROE?

c. What is the primary benefit of adopting the capital structure that generates the higher estimated ROE? What are two drawbacks to this approach?

Step by Step Answer: