Jones, Jackman and Johnson are partners in the consulting firm of Triple J Partners. The balance sheet

Question:

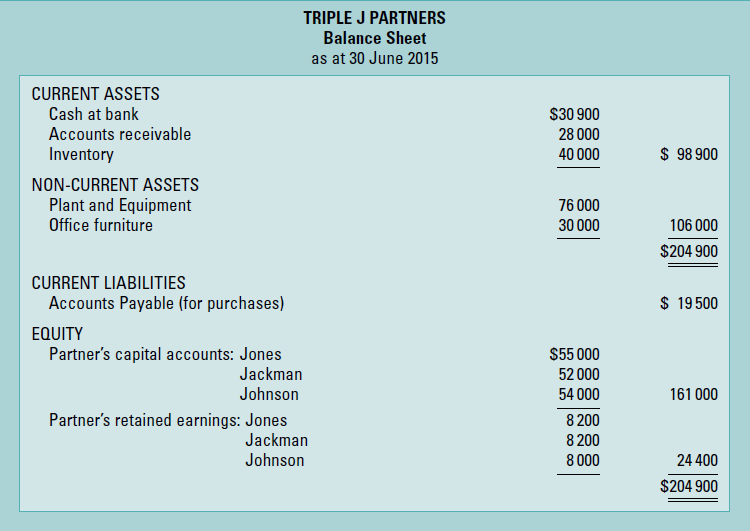

Jones, Jackman and Johnson are partners in the consulting firm of Triple J Partners. The balance sheet of the partnership as at 30 June 2015 is set out below.

It was agreed that all profits be divided equally between the partners.

Business transactions for the year were as follows (ignore GST):

Sales | $ | 368 600 |

Cash receipts: Sales collected | $ | 370 300 |

Cash payments: Purchases Salaries Office expenses Operating expenses Drawings: Jones Jackman Johnson | 220 000 50 000 19 100 34 000 9 360 9 750 9 200 | |

$ | 351 410 |

Inventory at 30 June 2016 was $38 700 and Accounts Payable was $18 000.

Non-current assets are depreciated at 10% per annum.

Required

A. Prepare the income statement for the year ended 30 June 2016.

B. Prepare a statement of changes in partners’ equity for the year ended 30 June 2016.

C. Prepare the balance sheet as at 30 June 2016.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Accounting

ISBN: 978-1118608227

9th edition

Authors: Lew Edwards, John Medlin, Keryn Chalmers, Andreas Hellmann, Claire Beattie, Jodie Maxfield, John Hoggett