Kaitlyns Cats Inc. (KCI) is a chain of pet stores that specializes in the sale and veterinary

Question:

Kaitlyn’s Cats Inc. (KCI) is a chain of pet stores that specializes in the sale and veterinary care of felis catus, more commonly known as domestic cats. On October 1, 2021, KCI raised a net of $523,973 by issuing $500,000 in 10-year, 6% bonds that pay interest on April 1 and October 1. The market rate of interest at time of issue was 5%. Transaction costs directly attributable to the debt issue totalled $15,000. KCI elected not to designate the liability as at fair value through profit or loss.

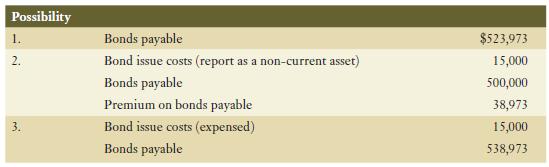

Kaitlyn Reid, owner of KCI, is contemplating how to present the bond indebtedness on KCI’s balance sheet at issue date. She has set out her initial thoughts as to some possibilities below in advance of her meeting with the company accountant to discuss this matter.

Required:

a. Discuss the advantages and disadvantages of each of the three methods being considered. Which of the three options complies with the requirements of IFRS 9?

b. What is the effective rate of interest on this obligation? Why is this rate used to determine interest expense rather than the stated coupon rate?

c. Why were investors willing to pay $538,973 for a debt instrument with a maturity value of $500,000?

d. Assume that KCI designated the liability as at fair value through profit or loss. Would your answer to part (a) change? If so, how would it change?

Step by Step Answer: