Listed below are 10 causes of temporary differences. For each temporary difference indicate the balance sheet account

Question:

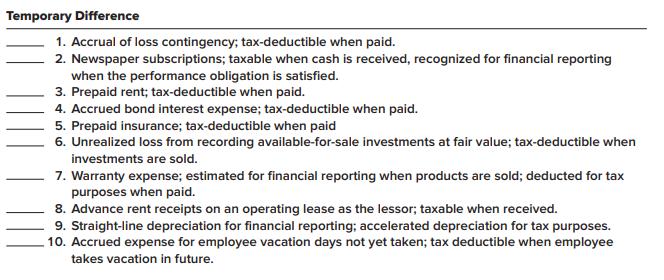

Listed below are 10 causes of temporary differences. For each temporary difference indicate the balance sheet account for which the situation creates a temporary difference.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Temporary Difference 1. Accrual of loss contingency; tax-deductible when paid. 2. Newspaper subscriptions; taxable when cash is received, recognized for financial reporting when the performance obligation is satisfied. 3. Prepaid rent; tax-deductible when paid. 4. Accrued bond interest expense; tax-deductible when paid. 5. Prepaid insurance; tax-deductible when paid 6. Unrealized loss from recording available-for-sale investments at fair value; tax-deductible when investments are sold. 7. Warranty expense; estimated for financial reporting when products are sold; deducted for tax purposes when paid. 8. Advance rent receipts on an operating lease as the lessor; taxable when received. 9. Straight-line depreciation for financial reporting; accelerated depreciation for tax purposes. 10. Accrued expense for employee vacation days not yet taken; tax deductible when employee takes vacation in future.

Step by Step Answer:

Liability It is also known as future sacrifices of economic benefits A liability is something that a company or a person owes in present for future be...View the full answer

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

Listed below are 10 causes of temporary differences. For each temporary difference, indicate (by letter) whether it will create future deductible amounts (D) or future taxable amounts (T). Temporary...

-

Scope Creep in Project Management A projects scope, as you would know, is everything that needs to be achieved in the project. It is a list of all that youll produce by the end of the project, and...

-

Listed below are several transactions. For each transaction, indicate by letter whether the cash effect of each transaction is reported in a statement of cash flows as an operating (O), investing...

-

What is the charge of the iron ion released upon dissolvingFe(NH 4 ) 2 (SO 4 ) 2 ?Remember the charges of the polyatomic ions NH 4 andSO 4 and that the entire compound will be chargeneutral. a). 8+...

-

You have collected the following data: Required: Use the concept of the life cycle of a business to rank these companies according to the following categories: pre-teenaged, teenaged, middle-aged,...

-

Campus Theater adjusts its accounts every month. The companys unadjusted trial balance dated August 31, 2015, is on page 176. Additional information is provided for use in preparing the companys...

-

A beam of electrons, a beam of protons, and a beam of oxygen atoms each pass at the same speed through a 1-,m-wide slit. Which will produce the widest central maximum on a detector behind the slit?...

-

Ehrling Brothers Company makes jobs to customer order. During the month of July, the following occurred: a. Materials were purchased on account for $45,670. b. Materials totaling $40,990 were...

-

You prepared for this assignment by completing this weeks discussion activity, in which you conducted a search of the research literature and wrote a draft literature review of four peer-reviewed...

-

TufStuff, Inc., sells a wide range of drums, bins, boxes, and other containers that are used in the chemical industry. One of the companys products is a heavy-duty corrosion-resistant metal drum,...

-

Listed below are 10 causes of temporary differences. For each temporary difference, indicate (by letter) whether it will create future deductible amounts (D) or future taxable amounts (T). Temporary...

-

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: The enacted tax rate is 25%. Required: For...

-

Jessi Paulis started a consulting firm, Paulis Consulting Ltd., on May 1, 2017. The following transactions occurred during the month of May. May 1 Paulis invested £8,000 cash in the business in...

-

Assume you are starting an online subscription based business. Answer all three questions. a. What does an annual "churn" rate of 8% mean and why is it important to you? (1 point) b. What is a...

-

Sobeys Inc is a Canadian grocery retailer with approximately 1,500 stores across Canada under a variety of retail banners, including Sobeys, IGA, Foodland, Thrifty Foods and FreshCo. The company is...

-

Your company is scheduled to receive 2,000,000 euros in 1 year. The euro is currently trading at 1.0813, you can borrow in the US for 1 year at 5.5% or invest in the US at 5.2%. You can borrow in...

-

The APR on a 14-day loan from Moneytree is: Group of answer choices .05% Okay. Give me a hint. What's an APR? 17% 460%

-

Plan to deliver a presentation to senior management to explain and gain support for your workforce planning and your completed staffing action plan. Ensure your presentation: a. exemplifies...

-

Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,000,000 or its yen equivalent, in a covered interest...

-

Troy is a qualified radiologist who operates a successful radiology practice from purpose- built rooms attached to his house. Troy works in the practice three days a week, and the other two days he...

-

Comprehensive Fixed-Asset Problem Darby Sporting Goods Inc. has been experiencing growth in the demand for its products over the last several years. The last two Olympic Games greatly increased the...

-

Impairment Roland Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2009 for $10,000,000 and had an estimated useful life of 8 years with no...

-

Comprehensive Depreciation Computations Kohl beck Corporation, a manufacturer of steel products, began operations on October 1, 2009. The accounting department of Kohl beck has started the...

-

Provide an overview of the best practices in risk identification during the risk identification step.

-

Explain what role does "Lead Time and Process Speed" play in the implementation of Lean Six Sigma?

-

In recent years, some Walmart workers have staged public protests about inadequate wages and unfair treatment. A number of these employees claim that management has retaliated against them for...

Study smarter with the SolutionInn App