Mona Kamaka, CPA, was retained by Downtown TV Repair Ltd. to prepare financial statements for the month

Question:

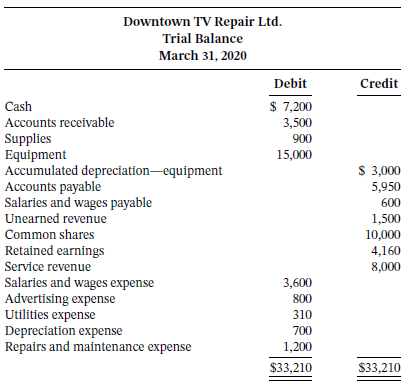

Mona Kamaka, CPA, was retained by Downtown TV Repair Ltd. to prepare financial statements for the month of March 2020. Mona accumulated all the ledger balances from the business records and found the following:

Mona reviewed the records and found the following errors:

1. Cash received from a customer on account was recorded as $570 instead of $750.

2. The purchase, on account, of equipment that cost $900 was recorded as a debit to Supplies and a credit to Accounts Payable for $900.

3. A payment of $30 for advertising expense was entered as a debit to Utilities Expense, $30, and a credit to Cash, $30.

4. The first salary payment this month was for $1,800, which included $600 of salaries and wages payable on February 28. The payment was recorded as a debit to Salaries and Wages Expense of $1,800 and a credit to Cash of $1,800. The business does not use reversing entries.

5. A cash payment for Repairs and Maintenance Expense on equipment for $90 was recorded as a debit to Equipment, $90, and a credit to Cash, $90.

Instructions

a. Prepare an analysis of each error that shows (1) the incorrect entry, (2) the correct entry, and (3) the correcting entry.

b. Prepare a corrected trial balance.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy