On July 1, 2020, Zoe Corporation purchased the net assets of Soorya Company by paying $415,000 cash

Question:

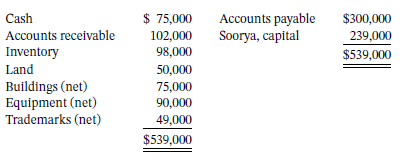

On July 1, 2020, Zoe Corporation purchased the net assets of Soorya Company by paying $415,000 cash and issuing a $50,000 note payable to Soorya Company. At July 1, 2020, the statement of financial position of Soorya Company was as follows:

The recorded amounts all approximate current values except for land (worth $60,000), inventory (worth $125,000), and trademarks (worthless). The receivables are shown net of an allowance for doubtful accounts of $12,000. The amounts for buildings, equipment, and trademarks are shown net of accumulated amortization of $14,000, $23,000, and $47,000, respectively.

Instructions

a. Prepare the July 1, 2020 entry for Zoe Corporation to record the purchase.

b. Assume that Zoe is a private entity and tested its goodwill for impairment on December 31, 2021. Management determined that the reporting unit?s carrying amount (including goodwill) was $500,000 and that the reporting unit?s fair value (including goodwill) was $450,000. Determine if there is any impairment and prepare any necessary entry on December 31, 2021. Zoe applies ASPE.

c. Repeat part (a), assuming that the purchase price was $204,000, all paid in cash.

d. Based on part (a), assume now that Zoe is a public entity and tested its goodwill for impairment on December 31, 2021. The cash-generating unit?s values (including goodwill) are as follows:

Carrying amount ................................................ $500,000Value in use ........................................................... 475,000Fair value ............................................................... 450,000Disposal costs ....................................................... 25,000

Determine if there is any impairment and prepare any necessary entry on December 31, 2021.

e. Digging Deeper Based on part (a), discuss factors that Zoe may have considered in deciding to pay total consideration of $465,000 for Soorya.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy