Pebble Pasta Corporation (PPC) recently decided to add a new line of sauces to its product mix.

Question:

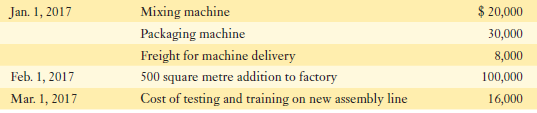

Pebble Pasta Corporation (PPC) recently decided to add a new line of sauces to its product mix. To do so, it had to acquire new equipment for a new assembly line. The following costs were incurred in early 2017 relating to the assembly line:

The mixing machine and the packaging machine are both about the same size, weight, and complexity.

The mixing machine and the packaging machine are both about the same size, weight, and complexity.

On March 31, 2017, testing ended and the new assembly line went into full production; shipments to customers began immediately. The company intends to produce sauces for the next 20 years, at which time the assembly line is expected to be completely obsolete with no salvage value.

On January 1, 2019, PPC realized that its mixing machine was too small due to its very successful entry into the sauce business. The company exchanged its mixing machine for a newer, higher-capacity machine that had a fair value of $25,000. The original manufacturer accepted the old machine plus $1,000 for the exchange. PPC incurred $3,000 to ship the old and new machines to their respective destinations. No additional testing or training was needed for the new machine because of its similarity to the old machine; otherwise, it would have cost $8,000 to test and train on the new machine.

Required:a. Calculate the amounts to be included in PPC??s property, plant, and equipment. Use separate asset categories where appropriate.b. PPC uses straight-line depreciation. Calculate the amount of depreciation expense for the year ended December 31, 2017, relating to the mixing machine, and prepare the related journal entry.c. Prepare the journal entry (entries) for the exchange of the mixing machines on January 1, 2019. State any assumptions required.d. What would be the journal entry (entries) for the exchange of mixing machines if your assumptions in part (c) were not valid?

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer: