Richardson Company cans a variety of vegetable-type soups. Recently, the company decided to value its inventories using

Question:

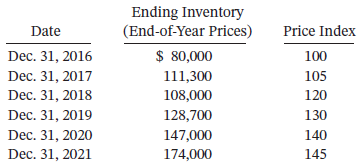

Richardson Company cans a variety of vegetable-type soups. Recently, the company decided to value its inventories using dollar-value LIFO pools. The clerk who accounts for inventories does not understand how to value the inventory pools using this new method, so, as a private consultant, you have been asked to teach him how this new method works. He has provided you with the following information about purchases made over a 6-year period.

You have already explained to him how this inventory method is maintained, but he would feel better about it if you were to leave him detailed instructions explaining how these calculations are done and why he needs to put all inventories at a base-year value.

Instructions

a. Compute the ending inventory for Richardson Company for 2016 through 2021 using dollar-value LIFO.

b. Using your computation schedules as your illustration, write a step-by-step set of instructions explaining how the calculations are done. Begin your explanation by briefl y explaining the theory behind this inventory method, including the purpose of putting all amounts into base-year price levels.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel