Second Thought Products (STP) began operations on January 1, 2021, and adopted the FIFO method of inventory

Question:

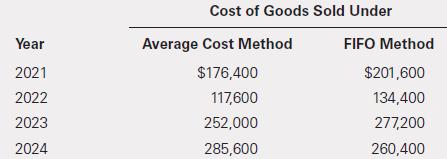

Second Thought Products (STP) began operations on January 1, 2021, and adopted the FIFO method of inventory valuation at that time. Management elected to change its inventory method to the average-cost method effective January 1, 2024. The new method more fairly presents the company’s financial position and results of operations. The following information is available for the years ended December 31, 2021, through December 31, 2024. STP is subject to a 40% income tax rate. The company still uses the FIFO method for income tax reporting.

Required

a. Compute the cumulative effect, net of tax, for the 3-year period needed to record a change from the FIFO method to the average-cost method.

b. Prepare the journal entry to record the change in accounting for inventory valuation.

c. Indicate where STP should report the net of tax cumulative effect, assuming that the first balance sheet presented is for the year ended December 31, 2023.

d. Indicate the cost of goods sold reported on the income statement for 2021, 2022, 2023, and 2024.

e. Assume that this change in principle is considered to be impractical. Indicate the cost of goods on the income statement for 2021, 2022, 2023, and 2024.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella