This assignment is a detailed examination of Skywalkers pension-related items. As of December 31, 2011, the $253

Question:

This assignment is a detailed examination of Skywalker’s pension-related items. As of December 31, 2011, the $253 in “Other long-term liabilities” reported by Skywalker (see Chapter 13) included an amount for a net pension liability. In addition, Skywalker’s $456 in “Other operating expenses” for 2011 included an amount for net pension expense.

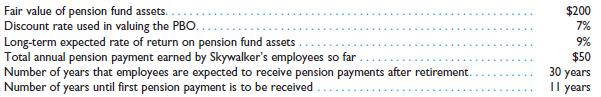

The following information relates to Skywalker’s pension plan as of December 31, 2011.

Construct a spreadsheet to calculate the following:

1. Given the information above, compute the net pension liability that Skywalker will report as of December 31, 2011. (Note: Be careful in computing the PBO; remember that the standard annuity formula yields the present value of the annuity one year before the first payment is received.)

2. Compute a forecast of Skywalker’s net pension liability as of December 31, 2012, and net pension expense for 2012 using the following information:

• By working an extra year in 2012, the total annual pension payment earned by Skywalker’s employees is expected to increase from $50 to $55.

• Skywalker’s employees will be one year closer to receiving the first pension payment.

• No pension benefits are expected to be paid to employees in 2012.

• Skywalker expects to contribute $50 to the pension plan during 2012.

• Skywalker’s best estimate is that the pension fund assets will earn in 2012 an amount equal to the long-term expected rate of return.

3. Repeat (1) and (2) using the following information:

(a) The discount rate is 8%, and the long-term expected rate of return on the pension fund assets is 12%.

(b) The discount rate is 5%, and the long-term expected rate of return on the pension fund assets is 11%.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0324592375

17th Edition

Authors: James D. Stice, Earl K. Stice, Fred Skousen