Wilson Foods Corporation leased a commercial food processor on September 30, 2021. The five-year finance lease agreement

Question:

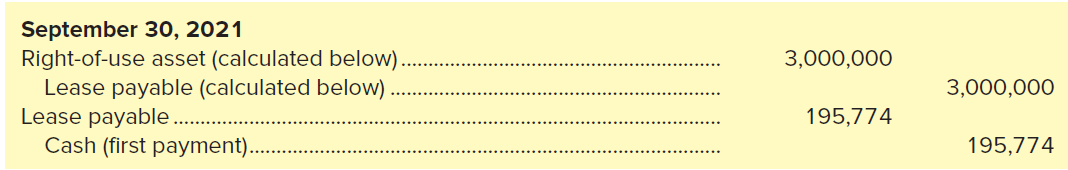

Wilson Foods Corporation leased a commercial food processor on September 30, 2021. The five-year finance lease agreement calls for Wilson to make quarterly lease payments of $195,774, payable each September 30, December 31, March 31, June 30, with the first payment at September 30, 2021. Wilson?s incremental borrowing rate is 12%. Wilson records amortization on a straight-line basis at the end of each fiscal year. Wilson recorded the lease as follows:

Calculation of the present value of lease payments$195,774 ? 15.32380* = $3,000,000(rounded)*Present value of an annuity due of $1: n = 20, i = 3% (from Table 6).

Required:What would be the pretax amounts related to the lease that Wilson would report in its statement of cash flows for the year ended December 31, 2021?

AnnuityAn annuity is a series of equal payment made at equal intervals during a period of time. In other words annuity is a contract between insurer and insurance company in which insurer make a lump-sum payment or a series of payment and, in return,... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas