You are employed by McDowell and Partners, Chartered Accountants (M&P). A new client, Community Finance Corporation (CFC),

Question:

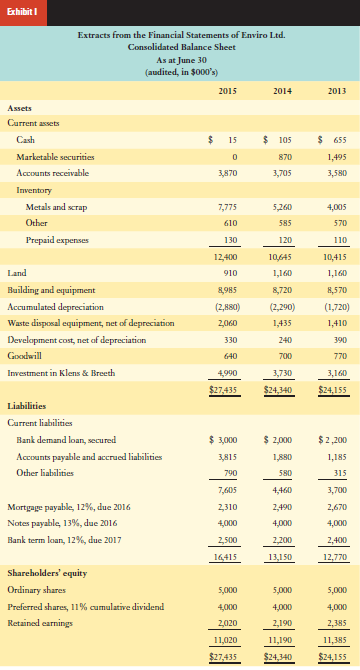

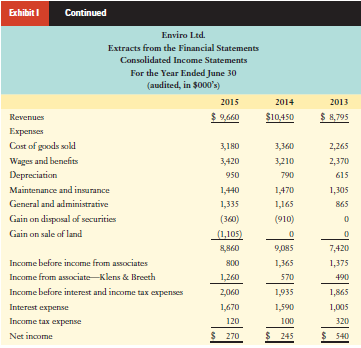

It is now August 2015. Enviro€™s board of directors have provided both CFC and M&P with recent financial statements (Exhibit I) and extracts from the working papers of Enviro€™s auditors, Y&Z, for the most recent year-end (Exhibit II). The engagement partner wants you to prepare a memo addressing CFC€™s concerns.

Required:

Prepare the memo requested by the engagement partner.

Exhibit II

Extracts from Y&Z€™s Working Papers

For the Year Ended June 30, 2015

Enviro

1. Enviro is a holding company that was incorporated under federal legislation several years ago as an investment company for a small group of investors. Enviro owns the following:

- 100% of the voting shares of Waste Disposal Corporation (WDC), which collects and disposes of environmentally hazardous chemicals.

- 50% of a partnership that specializes in designing advertisements for organizations that promote improvements to the environment. The partnership is called Klens & Breeth (KB). KB in turn owns all the voting shares of two corporations involved in advertising design and development.

- 100% of the voting shares of Scrap Metal Enterprises Ltd. (SMEL), which deals in the collection and sale of non-precious metals (copper, iron, and others).

2. Enviro€™s existing bank loans are secured by a first charge on receivables. The mortgage payable is secured by a first mortgage on the land and building. The notes payable are secured by inventory and are due in August 2016. The notes payable cannot be renewed because payment in full has been demanded.

3. Enviro is insured for liability and accidents but not for theft and fire.

4. Enviro paid dividends on preferred shares of $440,000 in each of 2013, 2014, and 2015. In addition, the company paid $100,000 of dividends on common shares in 2013.

Exhibit II

WDC

1. To meet government requirements, WDC€™s disposal equipment has to be upgraded by October 1, 2016; otherwise, large segments of the operations will have to be suspended and other safe disposal methods will have to be found€”an unlikely prospect. Upgrading is really the only. alternative if WDC is to avoid having to cancel contracts and incur significant cancellation penalties. Approximately $7 million is needed as soon as possible.

2. Using its own waste disposal technology, WDC builds some of the equipment that it needs to process certain wastes. During fiscal 2015, the following expenditures were capitalized:

Components and parts ........................................................... $322,100

Wages and benefits ................................................................ 208,220

Overhead costs ........................................................................ 208,000

Interest on borrowings ........................................................... 12,680

$751,000

The overhead costs are allocated based on roughly 100% of wages and benefits.

KB

1. We do not audit KB but have reviewed the audit working papers and have had discussions with KB€™s auditors. KB€™s income for the year ended March 31, 2015, was $2,520,000, and Enviro has appropriately accounted for its share using the equity method of accounting. Enviro is a silent partner. However, Enviro provides major assistance in developing new client contracts for KB. The other partner needs the partnership form of ownership for various purposes. Among the more significant transactions during fiscal 2015 were the following:

a. KB accounts for its investments on an equity basis; its subsidiaries paid cash dividends in fiscal 2015 of $1,200,000. KB retained these funds to develop new technology.

b. KB earned $1,875,000 from a federal government contract that has expired this month. Most of the fee was recognized in income in 2015 because the ideas had already been generated for another project and few additional costs were necessary.

c. The other partner of KB operates an advertising fi rm for non-environmental promotion. KB paid this firm $895,000 for a variety of services.

SMEL

1. SMEL€™s scrap metal piles are large, and it is difficult to estimate the quantity of metal in the piles. To satisfy ourselves, we photographed the piles, compared them geometrically to photographs of previous years, and discussed important issues with management. We also conducted extra checks of the perpetual inventory system against arrival and departure weights of rucks. The system was operating satisfactorily, but estimates were necessary for wastage.

2. The scrap metal is recorded at cost because resale prices of scrap vary considerably. If prices are low, SMEL stores the metals until selling prices improve. Management believes there is no need to sell at a loss.

3. The government requires a soil test of SMEL€™s scrap yard every five years. The most recent soil test was conducted four years ago.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer: