You are in your third year as an accountant with McCarver-Lynn Industries, a multidivisional company involved in

Question:

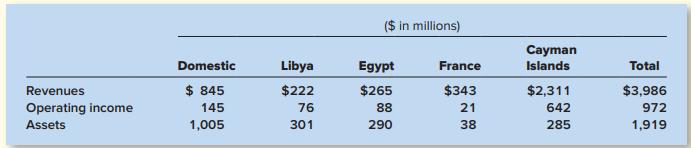

You are in your third year as an accountant with McCarver-Lynn Industries, a multidivisional company involved in the manufacturing, marketing, and sales of surgical prosthetic devices. After the fiscal year-end, you are working with the controller of the firm to prepare geographic area disclosures. Yesterday you presented her with the following summary information:

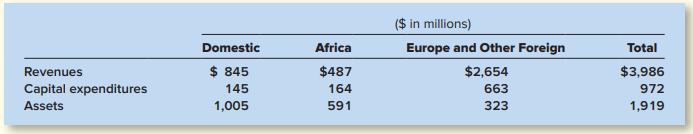

Upon returning to your office after lunch, you find the following memo:

Nice work. Let’s combine the data this way:

Because of political instability in North Africa, let’s not disclose specific countries. In addition, we restructured most of our French sales and some of our U.S. sales to occur through our offices in the Cayman Islands. This allows us to avoid paying higher taxes in those countries. The Cayman Islands has a 0% corporate income tax rate. We don’t want to highlight our ability to shift profits to avoid taxes.

Required:

Do you perceive an ethical dilemma? What would be the likely impact of following the controller’s suggestions? Who would benefit? Who would be injured?

Step by Step Answer:

Intermediate Accounting

ISBN: 9781259722660

9th Edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas