Corning-Howell reported taxable income in 2024 of $120 million. At December 31, 2024, the reported amount of

Question:

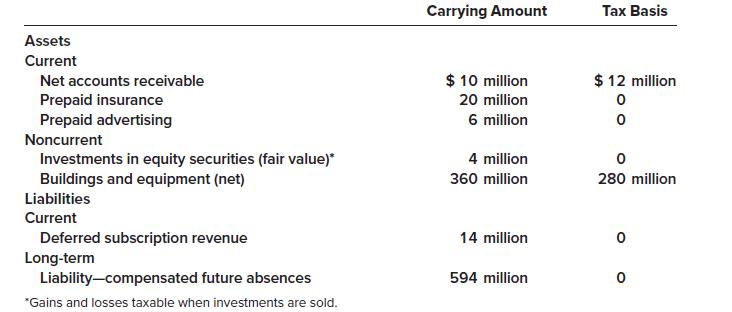

Corning-Howell reported taxable income in 2024 of $120 million. At December 31, 2024, the reported amount of some assets and liabilities in the financial statements differed from their tax bases as indicated below:

The total deferred tax asset and deferred tax liability amounts at January 1, 2024, were $156.25 million and $25 million, respectively. The enacted tax rate is 25% each year.

Required:

1. Determine the total deferred tax asset and deferred tax liability amounts at December 31, 2024.

2. Determine the increase (decrease) in the deferred tax asset and deferred tax liability accounts at December 31, 2024.

3. Determine the income tax payable currently for the year ended December 31, 2024.

4. Prepare the journal entry to record income taxes for 2024.

Step by Step Answer: