Dell Technologies is a leading global end-to-end technology provider, with a portfolio of hardware, software and service

Question:

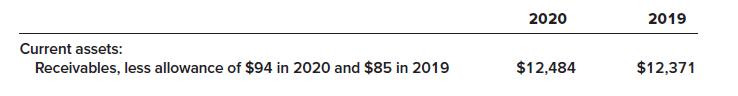

Dell Technologies is a leading global end-to-end technology provider, with a portfolio of hardware, software and service solutions. In a recent annual report, the balance sheet included the following information ($ in millions):

In addition, the income statement reported sales revenue of $92,154 million for the current year. All sales are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the current year was $91,868 million. There could have been significant recoveries of accounts receivable previously written off.

Required:

1. Compute the following ($ in millions):

a. The amount of bad debts written off by Dell during 2020 (Hint: Treat it as a plug in the gross accounts receivable account).

b. The amount of bad debt expense that Dell included in its income statement for 2020 (Hint: Treat it as a plug in the allowance for uncollectible accounts).

c. The approximate percentage that Dell used to estimate bad debts for 2020, assuming that it used the income statement approach.

2. Suppose that Dell had used the direct write-off method to account for bad debts. Compute the following ($ in millions):

a. The accounts receivable information that would be included in the 2020 year-end balance sheet.

b. The amount of bad debt expense that Dell would include in its 2020 income statement.

Step by Step Answer: