Western Trading plc is a company which uses a variety of component parts in its manufacturing operations.

Question:

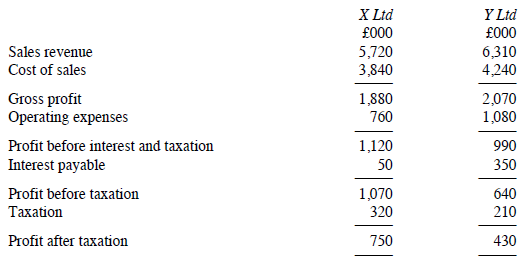

Statements of comprehensive income for the year to 31 December 2017

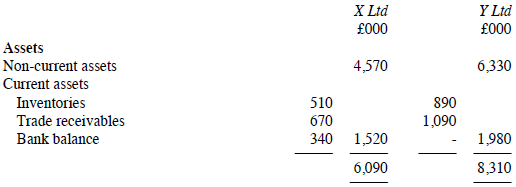

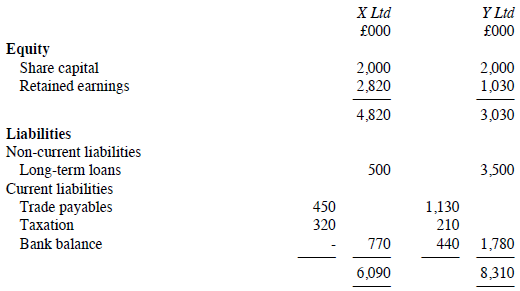

Statements of financial position as at 31 December 2017.

For both companies, all purchases and sales are made on credit terms.

Required:

(a) Calculate three profitability ratios, two liquidity ratios, three efficiency ratios and one gearing ratio for X Ltd and for Y Ltd.

(b) Use the information provided by these ratios to explain to the management of Western Trading plc which of the two companies seems likely to be the more reliable source of supply.

(c) Identify any further information which should be obtained before a final decision is made.

(CIPFA)

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville

Question Posted: