Aphrodite has a year end of 31 December and operates a factory which makes computer chips for

Question:

Aphrodite has a year end of 31 December and operates a factory which makes computer chips for mobile phones. It purchased a machine on 1 July 20X3. A fire at the factory on 1 October 20X6 damaged the machine leaving it with a lower operating capacity. The accountant considers that Aphrodite will need to recognise an impairment loss in relation to this damage. The accountant has ascertained the following information at 1 October 20X6:

• The carrying amount of the machine is $60,750.

• An equivalent new machine would cost $90,000.

• The machine could be sold in its current condition for a gross amount of $45,000. Dismantling costs would amount to $2,000.

• In its current condition, the machine could operate for three more years which gives it a value in use figure of $38,685.

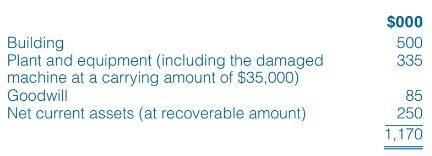

On 1 July 20X7, it is discovered that the damage to the machine is worse than originally thought. The machine is now considered to be worthless and the recoverable amount of the factory as a cash-generating unit is estimated to be $950 000. At 1 July 20X7, the cash-generating unit comprises the following assets:

Required:

(i) What is the total impairment loss associated with Aphrodite’s machine at 1 October 20X6?

(ii) In accordance with IAS 36, what will be the carrying amount of Aphrodite’s plant and equipment when the impairment loss has been allocated to the cash-generating unit?

Step by Step Answer:

International Financial Reporting And Analysis

ISBN: 9781473766853

8th Edition

Authors: David Alexander, Ann Jorissen, Martin Hoogendoorn