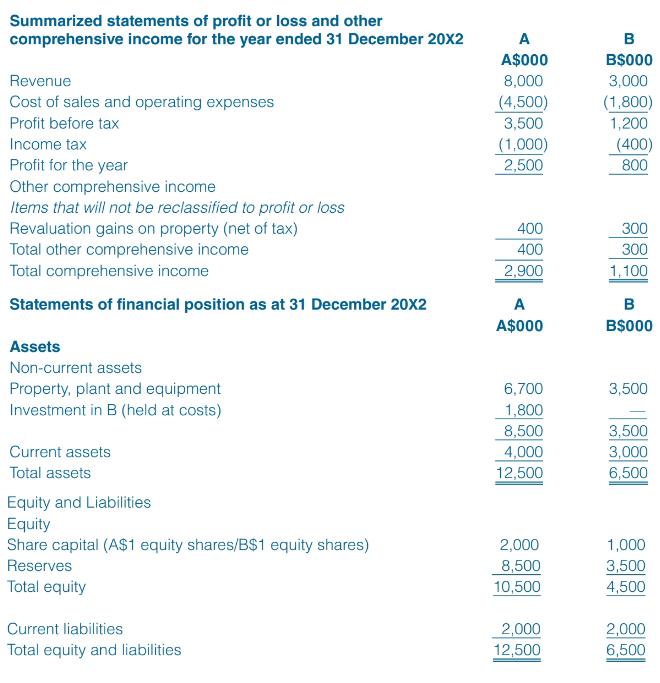

Extracts from the financial statements of A and its subsidiary B are presented below. Additional information: 1.

Question:

Extracts from the financial statements of A and its subsidiary B are presented below.

Additional information:

1. A acquired 80 per cent of the equity share capital of B on 1 January 20X0 for A$1,800,000 when the reserves of B were B$1,900,000. The investment is held at cost in the individual financial statements of A. There have been no issues of share capital since the date of acquisition.

2. The group policy is to value non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interest of B was A$410,000 at the date of acquisition.

3. The functional currency of A is the A$. The functional currency of B is the B$. Relevant exchange rates (where A$/B$ 2.00 means A$1 5 B$2.00) are:

1 January 20X0 A$/B$2.00

31 December 20X1 A$/B$2.10

31 December 20X2 A$/B$2.30

Average rate for the year ended 31 December 20X2 A$/B$2.20

4. An impairment review conducted on 31 December 20X1 resulted in the goodwill arising on the acquisition of B being written down by 20 per cent.

Required:

Prepare the following for the A group:

(a) The consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20X2

(b) The consolidated statement of financial position as at 31 December 20X2. (Please round all numbers to the nearest $000.)

Step by Step Answer:

International Financial Reporting And Analysis

ISBN: 9781473766853

8th Edition

Authors: David Alexander, Ann Jorissen, Martin Hoogendoorn