Silverago Incorporated, an international metals company, reported a loss on the sale of equipment of ($2) million

Question:

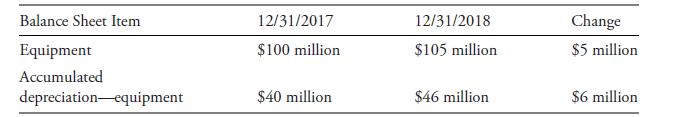

Silverago Incorporated, an international metals company, reported a loss on the sale of equipment of \($2\) million in 2018. In addition, the company’s income statement shows depreciation expense of \($8\) million, and the cash flow statement shows capital expenditure of \($10\) million, all of which was for the purchase of new equipment. Using the following information from the comparative balance sheets, how much cash did the company receive from the equipment sale?

A . \($1\) million.

B . \($2\) million.

C . \($3\) million.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

International Financial Statement Analysis Workbook

ISBN: 9781119628095

4th Edition

Authors: Thomas R. Robinson, Elaine Henry, Wendy L. Pirie

Question Posted: