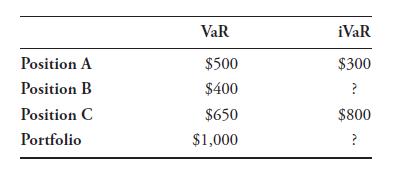

You have been given the following VaR and iVaR statistics for a portfolio that contains three positions.

Question:

You have been given the following VaR and iVaR statistics for a portfolio that contains three positions. What is the iVaR of Position B? Assume the iVaR and VaR are both one-day 95%, and have been calculated using the same methodology.

Transcribed Image Text:

Position A Position B Position C Portfolio VaR $500 $400 $650 $1,000 iVaR $300 ? $800 ? 'V

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

The iVaR of Position B is 100 For the portfolio as a w...View the full answer

Answered By

Jacob Festus

I am a professional Statistician and Project Research writer. I am looking forward to getting mostly statistical work including data management that is analysis, data entry using all the statistical software’s such as R Gui, R Studio, SPSS, STATA, and excel. I also have excellent knowledge of research and essay writing. I have previously worked in other Freelancing sites such as Uvocorp, Essay shark, Bluecorp and finally, decided to join the solution inn team to continue with my explicit work of helping dear clients and students achieve their Academic dreams. I deliver, quality and exceptional projects on time and capable of working under high pressure.

4.90+

1253+ Reviews

2845+ Question Solved

Related Book For

Quantitative Financial Risk Management

ISBN: 9781119522201,9781119522263

1st Edition

Authors: Michael B. Miller

Question Posted:

Students also viewed these Business questions

-

Suppose you are the manager for 3 West, a medical/surgical unit. You have been given the following data to assist you in preparing your budget for the upcoming fiscal year. Patient Data ADC: 54...

-

You have been given the following condensed financial data for two companies from different industries: Instructions Divide the class into groups. Assign half your group members to Utility Corp. and...

-

Solve each equation in Exercises. Round decimal answers to four decimal places. log 3 (x 2 + 17) - log3 (x + 5) = 1

-

On January 1, Harry's Hot Dogs purchased a hot dog stand for $120,000 with an estimated useful life of 10 years and no residual value. Suppose that after using the hot dog stand for four years and...

-

In Problem let g(x) = x 2 and find the given values without using a calculator. g(1); g(1.1)

-

The two wires are connected together at A. If the force P causes point A to be displaced horizontally 2 mm, determine the normal strain developed in each wire. C 300 mm 30 B 300 mm 30 A -P

-

Analyzing the Effects of Transactions in T-Accounts Lisa Frees and Amelia Ellinger had been operating a catering business for several years. In March 2011, the partners were planning to expand by...

-

Berset Inc. (BI) has just issued semi-annual coupon bonds with 12 years to maturity and a face value of $1,000 per bond. The bonds make semi-annual coupon payments of $60. What is the price of one...

-

The following transactions of Jacks Auto Supply occurred in November (Balances as of November 1 are given for general ledger and accounts receivable ledger accounts: Danielson $1,100 Dr.; Wallace...

-

The total VaR of a portfolio is $10 million. The portfolio contains a position in XYZ worth $1 million, with an iVaR of $3 million. What would the approximate VaR of the portfolio be if the XYZ...

-

You have created a Monte Carlo simulation to model the risk of a stock index over 10,000 days. All of the daily log returns have a mean, standard deviation, skewness, and excess kurtosis of 0.10%,...

-

How can the zero-beta CAPM be empirically tested with real-world data? Discuss two tests using equations based on the market model. Which test is more reliable and why?

-

Who is considered an invitee, and what duty of care is owed an invitee? a. How can one lose ones invitee status?

-

Who is considered a licensee, and what duty of care is owed a licensee?

-

What duty of care is owed a trespasser? a. What are the four exceptions to this general rule?

-

The name of the U.S. Supreme Court case that upheld noncompulsory workers compensation systems in 1917 was a. Miranda v. Arizona. b. Roe v. Wade. c. New York Central Railroad v. White. d. Brown v....

-

States limit the amount of compensation paid to injured workers by a. fixing a maximum wage on which compensation is paid. b. providing for payment of a percentage of the maximum monthly wage. c. not...

-

At December 31, 2011, the records of NCIS Corporation provided the following selected and incomplete data: Common stock (par $10; no changes during the year). Shares authorized, 200,000. Shares...

-

The Zwatch Company manufactures trendy, high-quality moderately priced watches. As Zwatch's senior financial analyst, you are asked to recommend a method of inventory costing. The CFO will use your...

-

How would a collar be valued practically? What is the explicit solution for a single payment?

-

When an index amortizating rate swap has a lockout period for the first year, we must solve with jump condition where g(r, i) =1 if ti < 1, and with final condition V(r, P, T ) = (r rf )P. In this...

-

Find the approximate value of a cashflow for a floorlet on the one-month LIBOR, when we use the Vasicek model.

-

Look at the effects on accrual income and cash basis income in the period revenue is accrued and in the next period when you collect cash. Also, look at the effects on accrual income and cash basis...

-

SEC Charges Ernst & Young, Three Audit Partners, and Former Public Company CAO with Audit Independence Misconduct: The Securities and Exchange Commission charged accounting firm Ernst & Young LLP...

-

The Carlile family wants to begin savings for their child's college. They begin contributing $ 4500 per year at the end of this year. They will continue contributing to the account until their...

Study smarter with the SolutionInn App